Blog Post

Tax Credits for Window Replacement

Why the 30-30 Requirement for Windows Isn't Very Smart

Last week, I provided an overview of the 30% federal tax credits that are in place for 2009 and 2010 for residential energy upgrades. Most of the provisions of those tax credits are very good. In the rush to do a lot very quickly, though, some mistakes were made. One such mistake, in my opinion, has to do with the credit provided for window replacement.

By way of background, under the 2005 Energy Policy Act (EPAct), homeowners were able to get a 30% tax credit of up to $200 for replacing windows. The measure was intended to improve energy performance, but in fact, virtually any window qualified, so it became a give-away to people remodeling their homes and replacing windows. It also cost taxpayers a lot--more than half of the money spent on the diverse tax credits under EPAct was for window replacement.

Under the American Recovery and Reinvestment Act of 2009, the cap on the window replacement tax credit has been raised to $1,500--more than seven times the cap in EPAct. So what's not to like about that? The problem is that it sets a maximum "solar heat gain coefficient" for windows of 0.30. Solar heat gain coefficient (SHGC) is a measure of transmissivity--how much solar energy gets through the window. A SHGC value of 0.30 means that just 30% of the sunlight is transmitted. Such a low SHGC is a good idea in hot climates, especially on east- and west-facing windows, to prevent overheating. But it doesn't make sense in northern climates where we want to benefit from the warmth from sunlight--as in solar tempering or passive solar heating.

To the credit of the policy makers, with the Recovery Act there was an effort to create a more rigorous standard for window performance. Along with the SHGC 0.30 limit, they established a maximum U-factor of 0.30. U-factor is a measure of the amount of heat transmitted through a window--the lower the number the less heat gets through. U-factor is the inverse of R-value, so that a U-factor 0.30 window would have an average R-value of 3.3. This is a "unit" value based on standards from the National Fenestration Rating Council (NFRC), meaning that it accounts for heat loss through the window edges and frame as opposed to just the "center-of-glass" value.

A window with a unit U-factor of 0.30 is fairly good. To get to that level of performance, it needs to have insulated glass with a low-emissivity (low-e) coating and a low-conductivity gas fill, such as argon. I would have liked to have seen it even tighter--say 0.25 or 0.20 to create demand for triple-glazed windows--but 0.30 is a lot better than what was required under EPAct.

SUPPORT INDEPENDENT SUSTAINABILITY REPORTING

BuildingGreen relies on our premium members, not on advertisers. Help make our work possible.

See membership options »To achieve both the 0.30 SHGC and 0.30 U-factor requirements, you have to use glass with a special low-e coating, such as the LoE3 glass made by Cardinal Glass Industries.

From what I've been able to learn in speaking with policy makers in Washington, this so-called "30-30 rule" came from the Joint Committee on Taxation, a quasi-independent committee of Congress that addresses the costs of legislation. They wanted to establish fairly stringent criteria to rein in the costs of the tax credit, according to Lowell Ungar, the director of policy at the Alliance to Save Energy in Washington.

As for where the specific 30-30 rule came from, one article attributes it to an aide of Maine Senator Olympia Snowe, who added it as final touches were being put on the bill at 3:00 in the morning. One has to wonder if Cardinal Glass Industries may have suggested those performance requirements. (Double glazing with Cardinal LoE3 366 and a half-inch space meets the requirement very nicely with a SHGC of 0.27 and a winter U-factor of 0.29 with air and 0.24 with argon).

Most energy experts I've spoken with argue that having a "one-size-fits-all" requirement for windows is a mistake. Such windows are not effective for passive solar gain. It doesn't make sense in northern climates, where solar gain can help in reducing heating costs. And it doesn't even make sense in more southern climates if one accepts the wisdom of specifying different glazings on different orientations--high-SHGC windows on the south and low-SHGC windows on the east and west.

One energy expert who likes the 30-30 rule is Arlene Stewart, president of AZS Consulting, a columnist for Door and Window Manufacturer and a board member of the Florida Home Builders Association. "From an implementation standpoint, it makes a lot of sense," she told me by e-mail. She thinks the standard will lower the cost of efficient windows because distributors won't have to keep a large number of options in stock. Regarding passive solar energy, Stewart dismisses the importance of passive solar. "I think that with the advent of forced-air systems, there is less of a need for passive solar," she said. "I don't think as many people occupy their homes at a time when passive solar is of most use. Unless we can figure out a way to capture that energy for use at a later time, I think the benefits are wasted since people are out of their homes Monday through Friday during daylight hours."

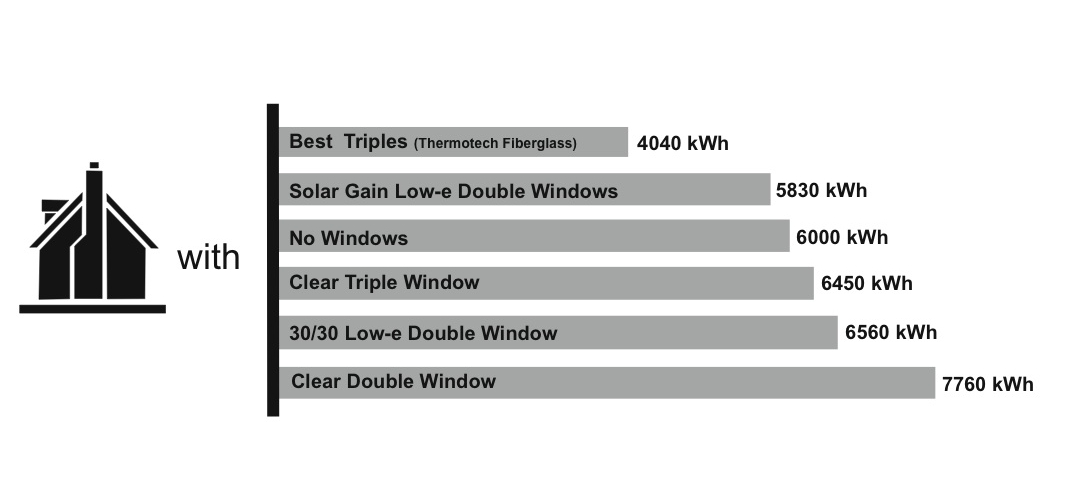

Stephen Thwaites of Thermotech Fiberglass Festration in Ottawa argues that in a northern climate even if the same glazing is used on every side of the house, a higher-SHGC glazing will significantly reduce energy consumption. Thwaites and an associate carried out energy modeling for me to make that case, as shown in the accompanying chart. In the Boston climate, based on HOT-2000 modeling runs of the highly insulated Minto Inspiration House in Manotick, Ontario, using 30-30 windows throughout the house results in a combined heating and cooling load of 6,560 kWh. When the house is modeled with higher-SHGC (0.48) and somewhat lower R-value windows (U-factor 0.34), the annual energy use for heating and cooling drops to 5,830 kWh (11% lower). Several other options are shown in the graph, including the best triple-glazed option from Thermotech.

"With very few exceptions," according to Thwaites, "a low-e window with a SHGC of 0.30 or lower is a bad window for houses in heating climates."

So what should we do? The answer is actually fairly simple: Use the 30% window replacement tax credit only for non-south-facing windows. For south-facing windows, skip the credit and install windows that transmit a lot more sunlight (SHGC of at least 0.45). In fact, maybe we can use the requirements of this new tax credit to finally get some traction for the idea of "tuning" windows by orientation (using different glazings for different orientations).

I invite you to share your comments on this blog. What do you think about the 30-30 rule for window replacement tax credits?

To keep up with my latest articles and musings, you can sign up for my Twitter feeds

Published February 1, 2010 Permalink Citation

(2010, February 1). Tax Credits for Window Replacement. Retrieved from https://www.buildinggreen.com/news-article/tax-credits-window-replacement

Add new comment

To post a comment, you need to register for a BuildingGreen Basic membership (free) or login to your existing profile.